irvine real estate tax rate

Investing in real estate. The County sales tax rate is.

Understanding California S Property Taxes

Pre-qualified vs pre-approved.

. Property taxes in California is currently 1 of the purchase price no matter where you buy a home in California. Our Premium Calculator Includes. The minimum combined 2022 sales tax rate for Irvine California is.

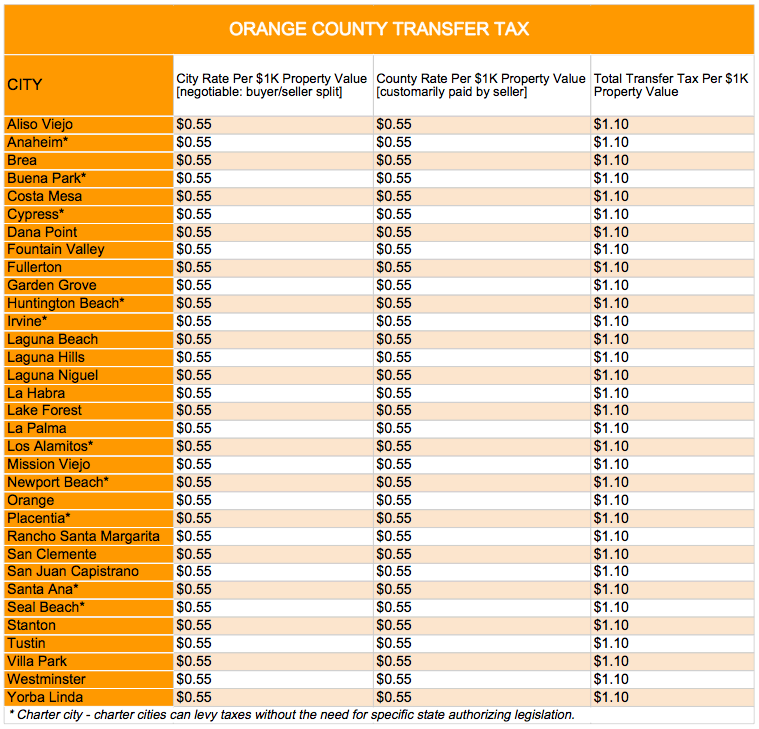

Please prove that you are human by solving the equation Renaud Denis REALTOR 949 774-8207. The current tax rate is 110 per 1000 or 055 per 500. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and Taxes with details on state and local sales income property and automobile taxes - Includes the cost of Child Care for toddlers or infants at a day.

900 County Avg 5600 8 Avg Sq. If you are already a resident just pondering moving to Irvine or interested in investing in its real estate find out how district property taxes function. Property taxes are collected by the Dallas County Tax Office in one installment.

The median property tax in California is 283900 per year for a home worth the median value of 38420000. Motor Vehicle Taxes Amount. Amortized Over 13 Years.

1529 County Avg 2314. All information deemed. Counties in California collect an average of 074 of a propertys assesed fair market value as property tax per year.

The seller pays the transfer tax in California. By Appointment Only. 6833 Quail Hill Pkwy Irvine CA 92603.

Assumes the local median home price and sales tax is amoritized over 13 years. Failure to pay these taxes before Feb. Tax amount varies by county.

Find All The Record Information You Need Here. While paying property taxes isnt particularly fun the revenue generated from Orange County property taxes is needed to provide funding for schools public libraries and other local projects and initiatives. Xinkuan Qian 8 Lowland Irvine CA 92602 Find homes for sale market statistics foreclosures property taxes real estate news agent reviews condos neighborhoods.

View listing photos review sales history and use our detailed real estate filters to find the perfect place. 1 results in a penalty of 6 percent plus 1 percent per month until July 1 when the penalty. The Irving City Council adopts a tax rate for property taxes each September when the budget is approved.

3309 Watermarke Pl Irvine CA 92612. 1 bd 1 ba 648 sqft. Who pays the transfer tax in California.

Property class Assessment value Total tax rate Property tax. Sales Transfer Tax Percentage. Please note that this is the base tax rate without special assessments or Mello Roos which can make the rate much higher.

Explore how Irvine sets its real estate taxes with our in-depth review. Bills are mailed about Oct. So if your home sells for 600000 the property transfer tax is 660.

Irvines appreciation rate over the last twelve months has been 1878 percent. The Irvine sales tax rate is. Average Property Tax Rate in Irvine.

Avg Taxes in Irvine. Unsure Of The Value Of Your Property. Ad Property Taxes Info.

Across Orange County the median home value is 652900 and the median amount of property taxes paid annually is 4499. 15 and are due Jan. Real Estate Taxes Amount.

Irvine real estate has appreciated by 9740 percent over the last decade which equates to an annual appreciation rate of 704 percent on average placing Irvine in the top 20 of all cities for real estate appreciation. The part that gets a little tricky is the city tax that is added on to this amount as well as the Mello Roos tax which will bump up this amount even higher. 074 of home value.

MLS ID OC22139768 Paul Daftarian Luxe Real Estate 949-484-0387. The California sales tax rate is currently. California has one of the highest average property tax rates in the country with only nine states.

Zillow has 480 homes for sale in Irvine CA. This is the total of state county and city sales tax rates. Aviles Real Estate Coldwell Banker Realty.

The Not So Ugly Truth About Mello Roos Taxes On Irvine Homes For Sale

Who Pays The Transfer Tax In Orange County California

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Orange County Ca Property Tax Calculator Smartasset

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Orange County Ca Property Tax Calculator Smartasset

Orange County Property Tax Oc Tax Collector Tax Specialists

Understanding California S Property Taxes

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Understanding California S Property Taxes

Understanding California S Property Taxes

Where Residents Are Most Likely To Pay State And Local Taxes Smartasset

Understanding California S Property Taxes

U S Property Taxes Levied On Single Family Homes In 2018 Increased 4 Percent To More Than 304 Billion Attom

Understanding California S Property Taxes

Cost Of Living In Irvine Ca Taxes Housing More Upgraded Home

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes